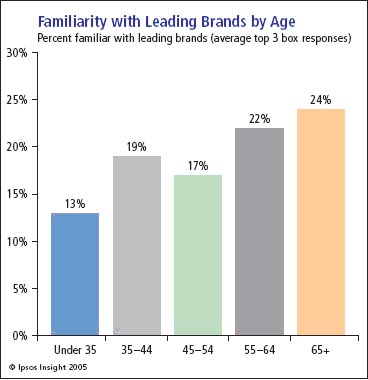

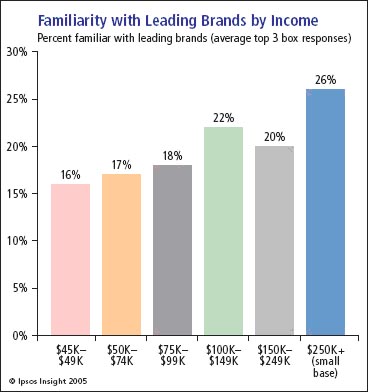

Survey reveals the ;familiarity with brands of leading Among increasing consumer interest in personal financial management, new research from Ipsos Insight shows that less than one-fifth of Americans know about leading financial brands, such as Bank of America, Fidelity, Allstate, Merrill Lynch, Metlife, Prudential Financial, and New York Life. Further, women lag behind their male counterparts: an average of only one in six American women is familiar with major financial services brands, even though women have improved financial independency. “Overall familiarity with key financial brands is surprisingly low, particularly given the marketing efforts of the big players,” said Doug Cottings, Senior Vice President of Ipsos Insight’s Financial Services Practice. “With a one-size-fits-all mindset, the financial services industry has yet to really connect with important segments, including women, young consumers, and many middle income families.” Younger Market Waiting in the Wings Other findings in the research show that as American age, there is a natural progression of familiarity with financial services brands; older consumers are more conscious of key brands. “Despite the financial services industry’s focus on the Baby Boomer market (those born between 1946 and 1964), the survey reveals that most Americans aren’t familiar with the range of financial services brands until after retirement age. By then, most consumers have made their most important financial decisions,” said Cottings. “There is a real opportunity for the financial community to build brand awareness in the younger market, including the Baby Boomers that have yet to retire.” Income is also a significant factor in determining the familiarity of brands in financial services: customers with household incomes about $100,000 a year have the strongest knowledge of major financial brands. “To sustain long-term growth, the industry should focus on power branding in different demographic and sociographic segments of the population. Despite the fact that most financial companies target the expected audience—which is male, mature, and wealthy—companies should see that there is great potential in the younger generations, especially among females who are financially successful, independent, and more conscious of their financial health,” said Cottings. “For financial companies, such opportunity is hard to ignore.” Methodology These national survey research data were collected via Ipsos U.S. Express, a weekly national omnibus survey. Fieldwork was conducted between June 30th and July 18th, 2005. Data are based on 2,687 telephone surveys taken with adults (18+) across the For more information on this press release, please contact:Doug Cottings, Senior Vice President, Financial Services Practice, Ipsos Insight, doug.cottings@ipsos-na.com ; All of the above text is a press release provided by the quoted organization. globalagingtimes.com accepts no responsibility for their accuracy.

AgeEconomie – Silver économie – Marché des Seniors

Le Portail d'actualité et d'analyses du Marché des Seniors et de la Silver économie